Fd In Post Office

Post Office FD Rates 2022 : Current Interest Rate 6.7%, Schemes - Scripbox

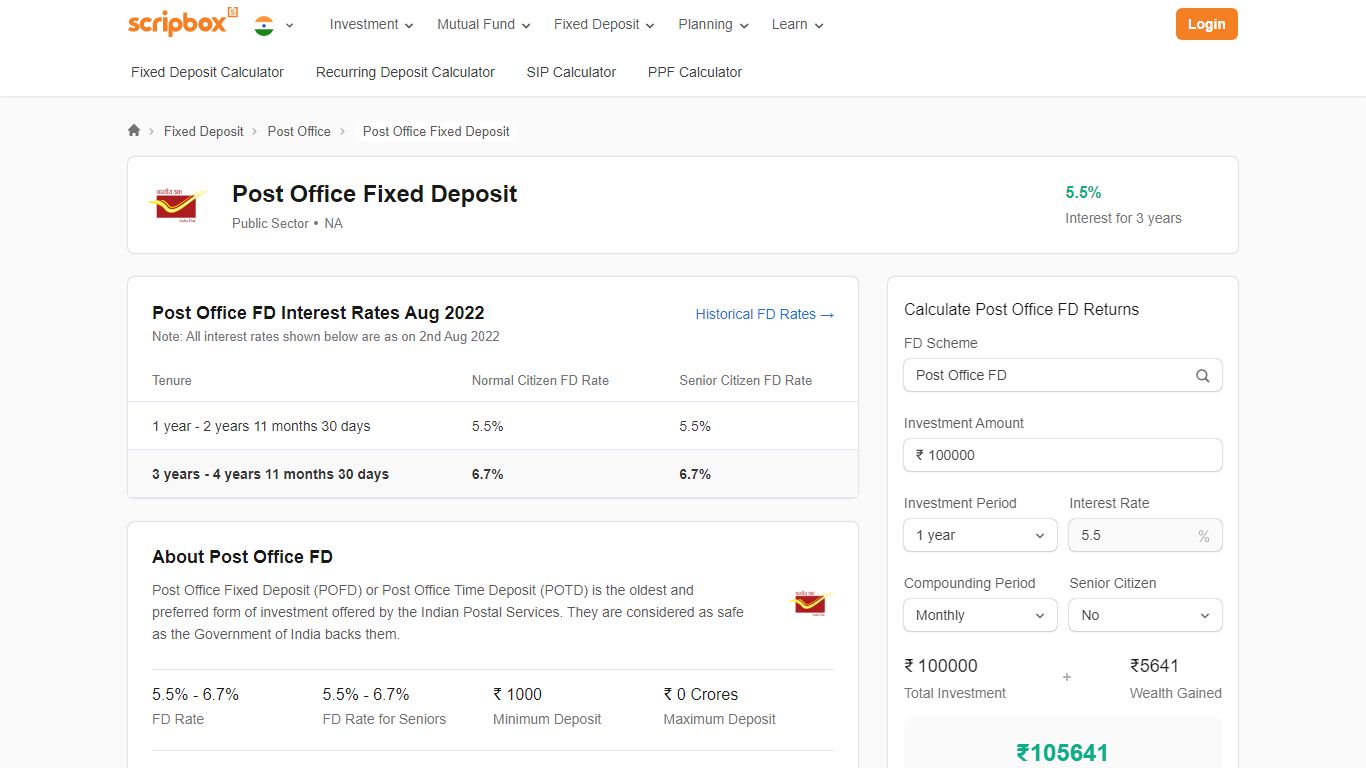

About Post Office FD Post Office Fixed Deposit (POFD) or Post Office Time Deposit (POTD) is the oldest and preferred form of investment offered by the Indian Postal Services. They are considered as safe as the Government of India backs them. 5.5% - 6.7% FD Rate 5.5% - 6.7% FD Rate for Seniors ₹ 1000 Minimum Deposit ₹ 0 Crores Maximum Deposit days

https://scripbox.com/fixed-deposit/post-office-fd-rates

Post Office FD Rates: Check Latest FD Interest Rates & Schemes

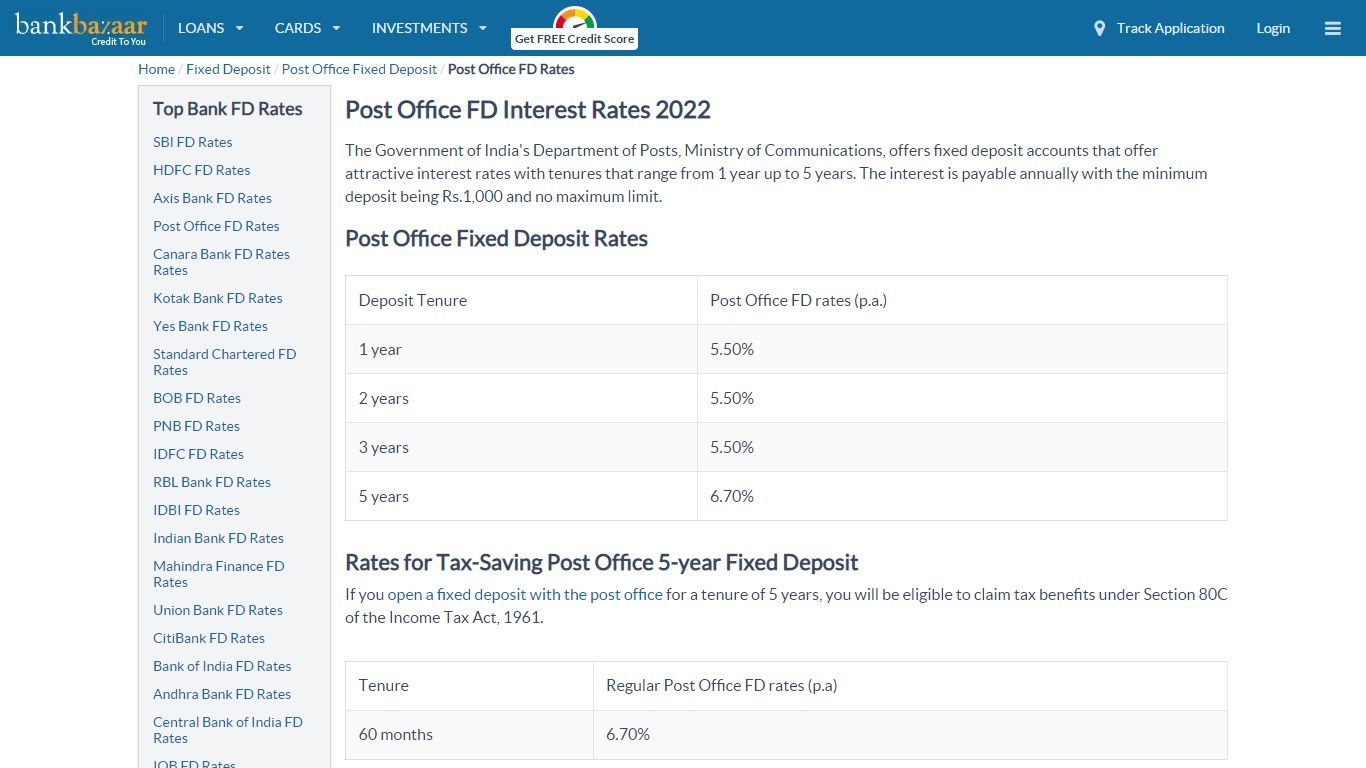

India Post, which operates the post offices in our country, offers post office FD interest rates of 5.50 - 6.70% p.a. for tenures ranging from 1 year to 5 years. The interest rate on Post Office Tax Saving FD is 6.70% p.a. for the general public.

https://www.paisabazaar.com/fixed-deposit/post-office-fixed-deposit-rates/Post Office FD Calculator : Calculate Interest Returns 2022 - Scripbox

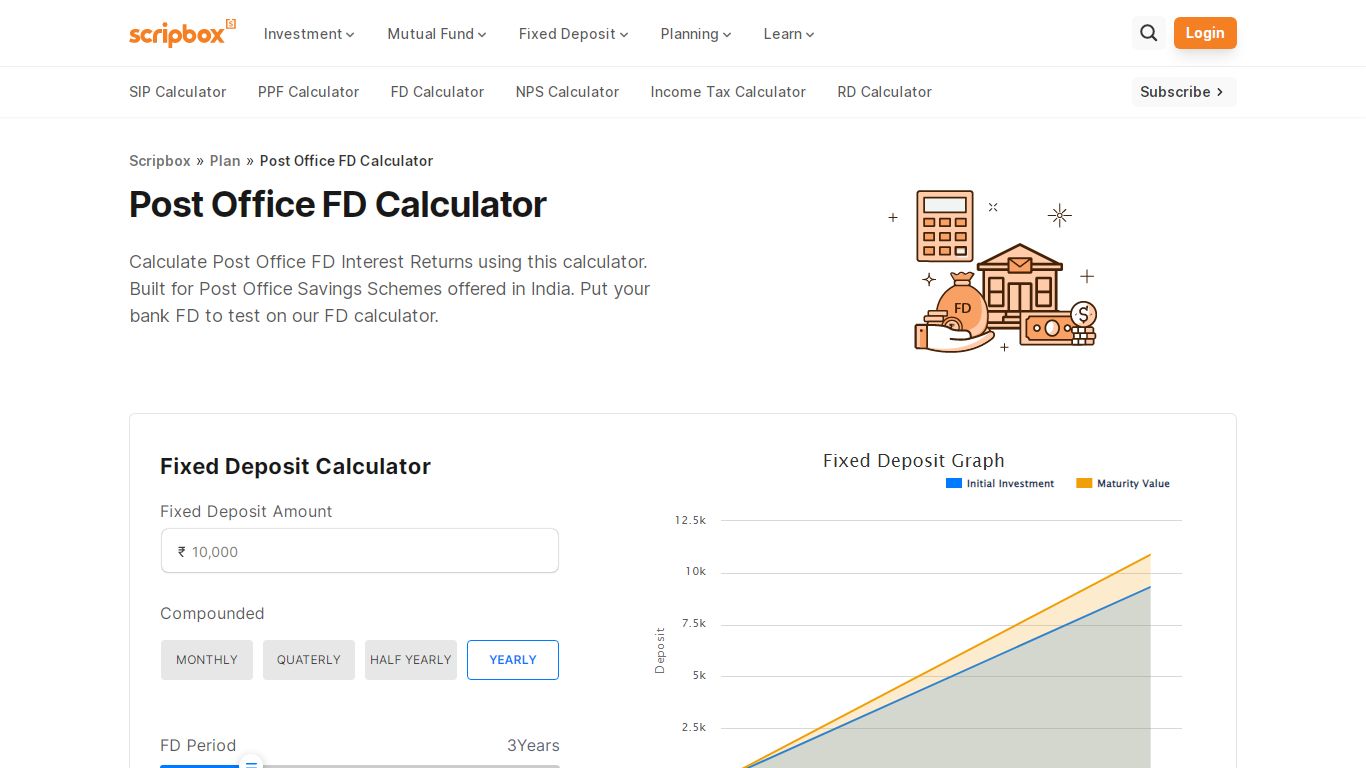

Post Office Fixed Deposit (POFD) maturity value can be calculated using the following formula. Maturity value = Principal * (1+Interest rate/4) (n*4) N is the number of years The interest rate should be the annual rate. The above formula is for interest compounded quarterly. Example: Akhil invested INR 2,50,000 in a POFD at 7% for three years.

https://scripbox.com/plan/post-office-fd-calculator/

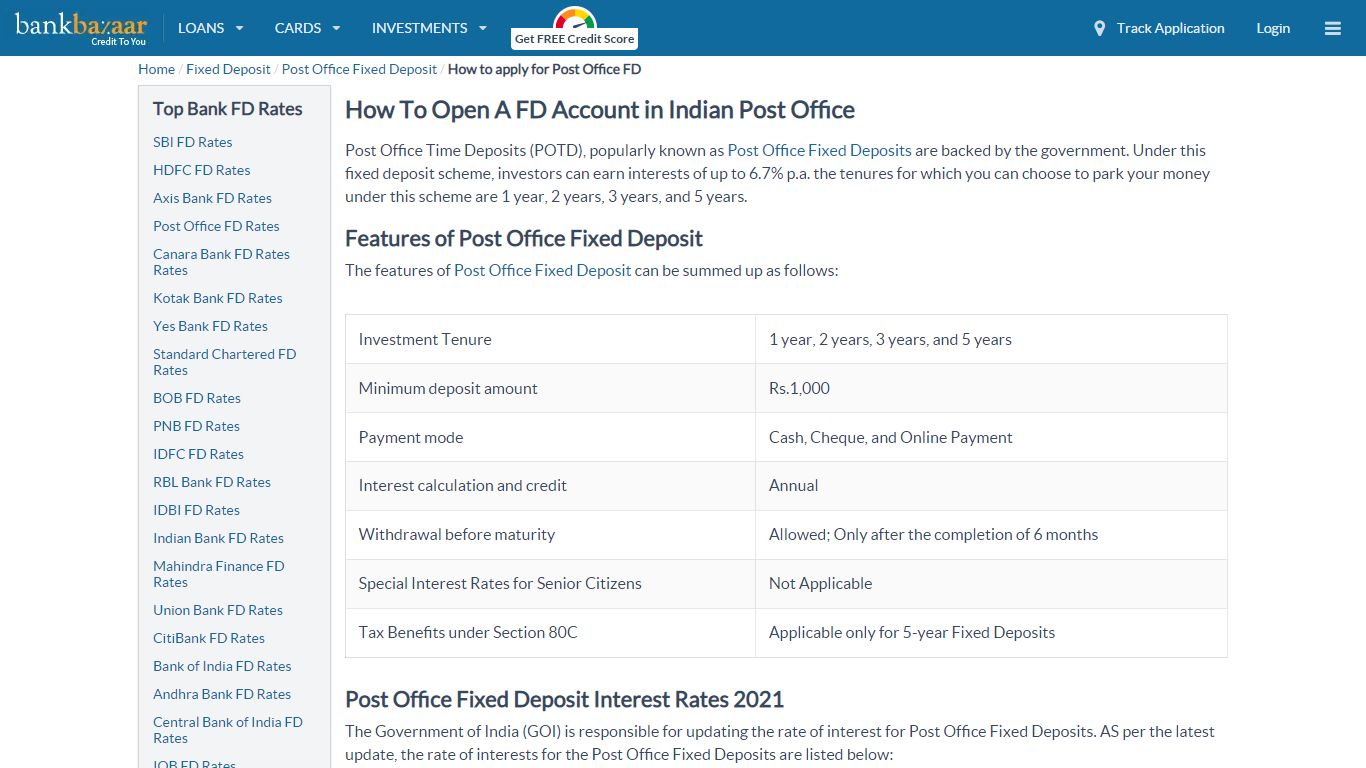

Post Office FD Rates 2022 - Latest Post Office FD Schemes - BankBazaar

The Post Office Time Deposit (TD) Account, also known as the Post Office Fixed Deposit (FD) account, can be opened with a minimum of Rs.1,000 in multiples of Rs.100, with no maximum limit. Highlights of Post Office FD Interest Rates Highest Post Office TD interest rate: 6.70% p.a. for a tenure of 5 years

https://www.bankbazaar.com/fixed-deposit/post-office-fixed-deposit-rate.html

Post Office Fixed Deposit Calculator Online - Groww

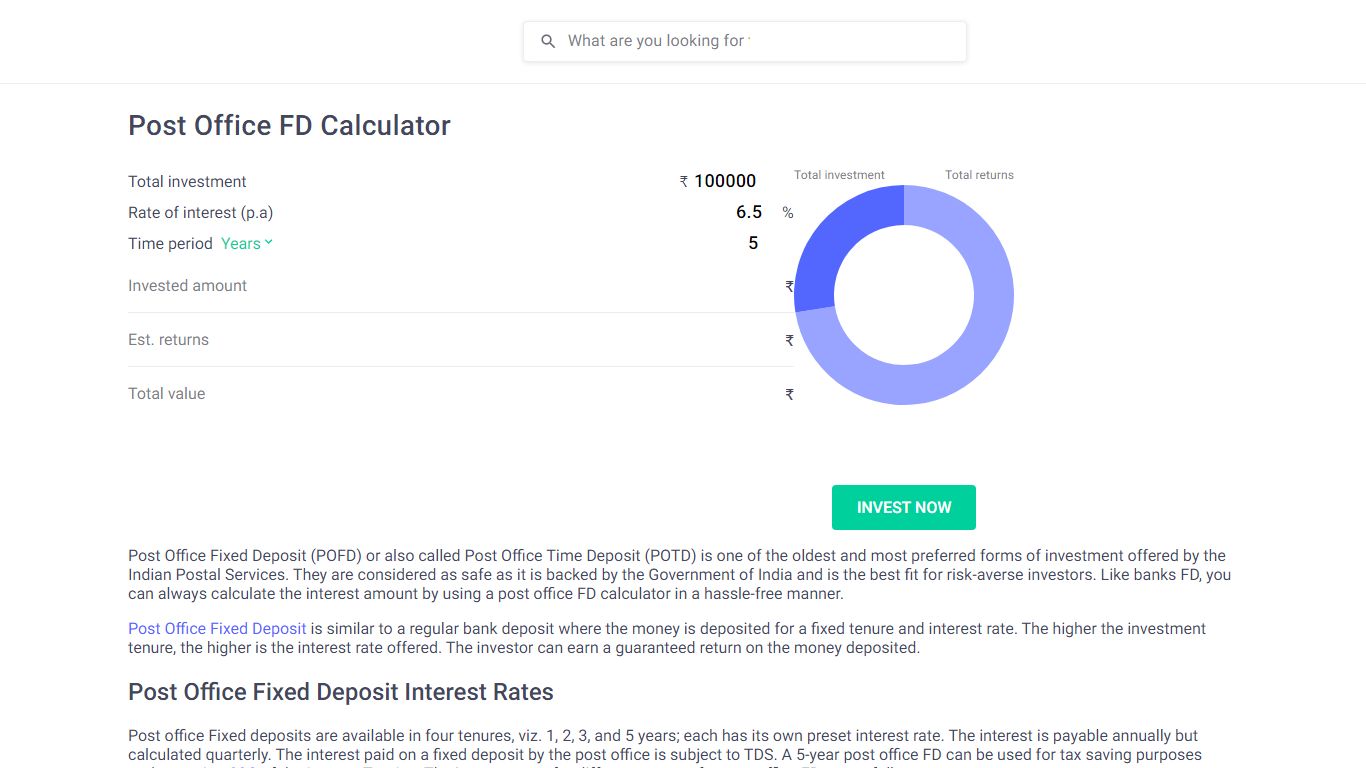

Calculating post office FD interest payout is pretty simple; all you have to do is use the compound interest formula given below for all the required details. Maturity Value = Principal * (1 + Interest Rate/4)^ (n*4) Where n is the number of years And the interest rate should be the annual rate.

https://groww.in/calculators/post-office-fd-calculator

Post Office Fixed Deposit (FD) Scheme - Policybazaar

The fixed deposit interest rate currently varies from 6.9% to 7.7%. The FD interest that is paid is charged with Tax Deduction at Source ( TDS ). By investing in this deposit scheme one can get tax benefits under section 80C in the old tax regime. The FD scheme or post office time deposit makes a good alternative to the bank FD.

https://www.policybazaar.com/life-insurance/investment-plans/articles/post-office-fixed-deposit-scheme/Is FD in post office taxable? - FinanceBand.com

One of the most preferred investments of post office is Time Deposit Scheme. Is 5 year FD tax free? Tax-saving FD allows you to make an investment to save tax under section 80C of the Income Tax Act. The minimum tenure for a term deposit under Tax Saving Scheme is 5 years. You can get a tax exemption of a maximum of Rs. 1.5 lakh.

https://financeband.com/is-fd-in-post-office-taxable

How To Open FD In Post Office - Know Step by Step Procedure - BankBazaar

Multiple FD accounts can be opened in any post office across the country Attractive rate of interest Nominal deposit terms wherein minimum deposit amount is Rs.1,000 only Nomination facility available for Post Office Time Deposit (POTD) accounts Joint FD accounts allowed with up to 3 members for each account Explore FD rates

https://www.bankbazaar.com/fixed-deposit/apply-for-post-office-fixed-deposit.html

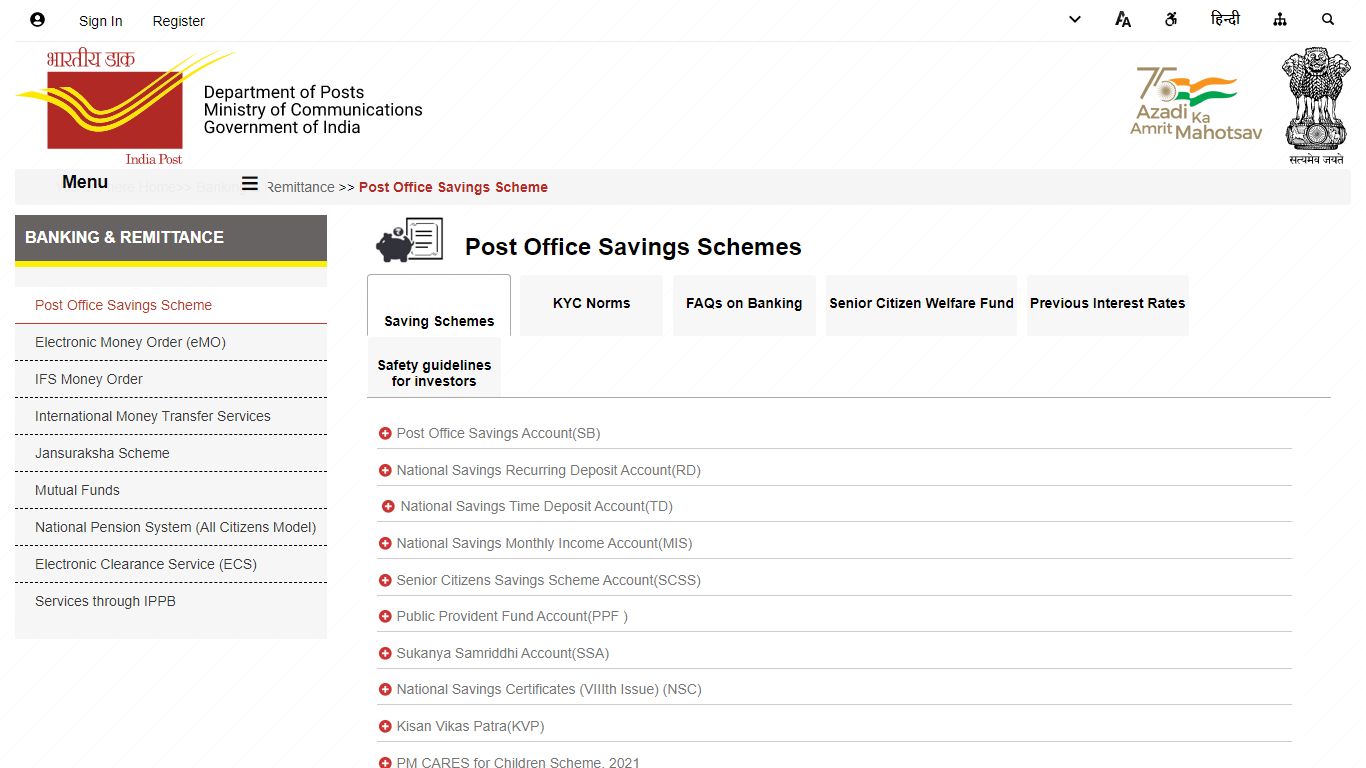

Post Office Saving Schemes - India Post

Post Office Savings Account (SB) National Savings Recurring Deposit Account (RD) National Savings Time Deposit Account (TD) National Savings Monthly Income Account (MIS) Senior Citizens Savings Scheme Account (SCSS) Public Provident Fund Account (PPF ) Sukanya Samriddhi Account (SSA) National Savings Certificates (VIIIth Issue) (NSC)

https://www.indiapost.gov.in/Financial/Pages/Content/Post-Office-Saving-Schemes.aspx

Post office FD Calculator - INDMoney

Calculating returns from post office fixed deposits is done using the following formula: M = P x (1 + i/4)^ (n x 4) Where, M = Final value of the maturity P = Principal invested amount i = Interest rate offered in the FD n = tenure of investment in years An example will help us to understand this in a better way.

https://www.indmoney.com/calculators/post-office-fd-calculator